Apple Pay Cash is one of many modern payment methods that have risen in recent years. You can use both this and Apple Pay across the US, and it’s a convenient way to control your spending. But if you haven’t used it before, you may have several questions about Apple Pay Cash and how you use it. Before using the feature, it’s a good idea to do some research.

If you want to learn more about Apple Pay Cash, you’re in the right place. Today, we’ll cover some of your most commonly asked questions about Apple Pay Cash.

Contents

- What Is Apple Pay Cash?

- Can Anyone Use Apple Pay Cash?

- Which Apple Devices Support Apple Pay Cash Feature?

- What Are the Limits When Using Apple Pay Cash?

- Apple Pay Cash Limits

- Apple Cash Family Limits

- Is Apple Pay Cash Tied to My Apple ID?

- Can I Use Apple Pay Cash on All My Devices?

- How Do I set Up and Use Apple Pay Cash?

- What Happens if I Lose My iPhone With Apple Pay Cash?

- 1. Log Into Your iCloud Account Via a Web Browser

- Report Your Lost Device

- How Do You Close an Apple Pay Cash Account?

- Is Apple Pay Cash Just a Fad?

- Can I Use Apple Pay Cash on Android?

- Is Apple Pay Cash Available in Europe?

- Are There Any Fees Associated With Apple Pay Cash?

- How Long Do Apple Pay Cash Transactions Take to Reach My Bank Account?

- What Are Some Apple Pay Alternatives?

- Do All Stores Accept Apple Pay Cash?

- Will Apple Pay Cash Cancel My Transaction if I Don’t Have Insufficient Funds?

- Are There Monthly Fees for Using Apple Pay Cash?

- Important Considerations when Using Apple Pay Cash

- Everything You Need to Know About Using Apple Pay Cash

What Is Apple Pay Cash?

Apple Pay Cash is a payment method that lets you send or receive money between friends and family members. You can use the Messages app or Siri on multiple Apple devices (we’ll talk more about these later) to request money.

Apple Pay is very similar to Venmo, the PayPal-owned payment solution that facilitates online cash transfers between individual users.

Can Anyone Use Apple Pay Cash?

To use Apple Pay Cash, you need to be at least 18 years old (13 years old if you use Apple Cash Family). Moreover, you cannot use the service if you aren’t a US resident. When you first use the service, you must first complete an ID verification procedure; you can use your passport or driver’s license to confirm who you are.

Apple Pay Cash requires you to have a valid debit or credit card. You need to store this card in the Wallet app, and it will facilitate your transfers using the service.

While you need to meet a few requirements to use Apple Pay Cash, you don’t need to download an app.

Which Apple Devices Support Apple Pay Cash Feature?

You can use Apple Pay Cash on your iPhone, iPad, or Apple Watch. At the time of writing in February 2024, Apple Pay Cash is not available on Mac devices.

Besides meeting the device requirements, you should also ensure that your software meets the minimum requirements to use Apple Pay Cash. Your iPhone or iPad must have at least iOS 11.2 installed. As for Apple Watches, you should have at least watchOS 4.2 on your device.

If you want a complete overview of whether your device supports Apple Pay Cash or not, check out this guide to Apple Pay Cash device requirements on the Apple website.

What Are the Limits When Using Apple Pay Cash?

The limits for using Apple Pay Cash depend on whether you use the normal version or you have Apple Cash Family instead. We’ll cover both of those here.

Apple Pay Cash Limits

You are only allowed to have a maximum cash balance of $20,000 in your Apple Pay Cash holdings. Since you will be using your debit or your credit card to transfer money into your Apple Pay Cash account, you will need to check with your bank or credit card company for details.

As per Apple’s guidelines, the minimum amount you can transfer into your account from your bank is $10. Meanwhile, the maximum is $10,000. In a seven-day period, you’re allowed to add a maximum of $20,000 to your bank account.

When it comes to sending and receiving money between other people, you can receive between $1 and $10,000 in each message. However, you should also note that $10,000 is the maximum amount of money you can receive or send over the course of seven days. For bigger transaction volumes, you should look at alternative solutions.

Apple Cash Family Limits

If you’re an Apple Cash Family member, the limits are a bit tighter than is otherwise the case. Transactions must be at least $10, and the maximum you can send within seven days is $2,000.

Similarly, you can only receive a maximum of $2,000 per message and within a seven-day period. That figure is the same for maximum amounts when it comes to transferring money to your bank account. However, the limits for receiving money are lower; others can send you $1 at the very least.

If you’re part of the Apple Cash Family, you can send $4,000 over the course of seven days to your bank account or card.

Is Apple Pay Cash Tied to My Apple ID?

Yes. Like any Apple service offering, Apple Pay Cash is directly linked to your Apple ID. After setting up Apple Pay Cash on one device, you can use it on any eligible device where you’re signed in to iCloud with the same Apple ID.

If you plan on using Apple Pay Cash, you will need to set up two-factor authentication if you have not already done so. Two-factor authentication is an extra layer of security for your Apple ID designed to ensure that you’re the only person who can access your account, even if someone knows your password.

Can I Use Apple Pay Cash on All My Devices?

Since the Apple Pay Cash feature is directly linked with your Apple ID and your iCloud account, you can use it on any eligible device where you’re signed into using your Apple ID. You can also manage this process so that the feature is only available in a particular device of your choice, as opposed to all devices that you use.

To Turn off Apple Pay Cash on a certain device, tap on Settings > Wallet and Apple Pay > Turn off Apple Pay Cash.

How Do I set Up and Use Apple Pay Cash?

If you meet all the eligibility requirements for using the Apple Pay cash feature, setting it up is pretty easy and using it is remarkably intuitive.

Please refer to Apple’s How-To’s on How to set up and use this feature on your eligible Apple devices. Apple’s support document is very detailed and walks you through all the basics of using this exciting feature.

What Happens if I Lose My iPhone With Apple Pay Cash?

Whether you lost an iPhone, iPad, or Apple Watch with Apple Pay Cash — or your device was stolen — you should do a few things immediately.

1. Log Into Your iCloud Account Via a Web Browser

You should sign into iCloud and mark your device as lost. This way, any Apple Pay transactions will instantly be suspended. Follow the steps below to turn on Lost Mode if you lose your device:

- Go to icloud.com and sign into your account.

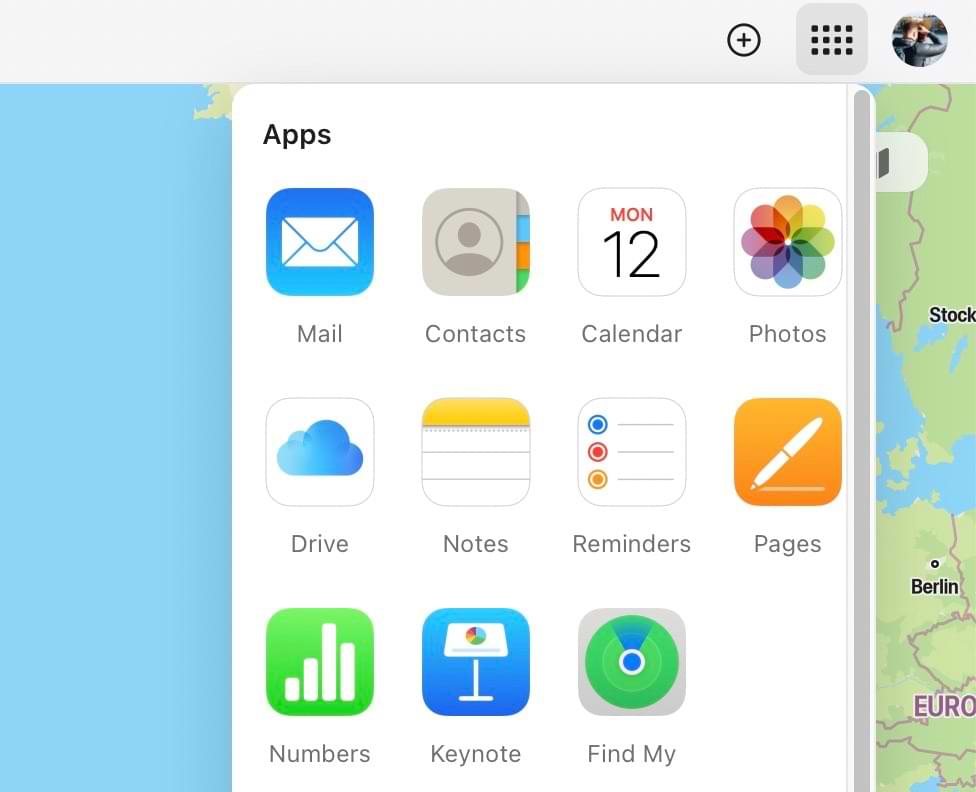

- Tap the icon with lots of squares in the top right-hand corner and select Find My.

- Enter your iCloud password when prompted.

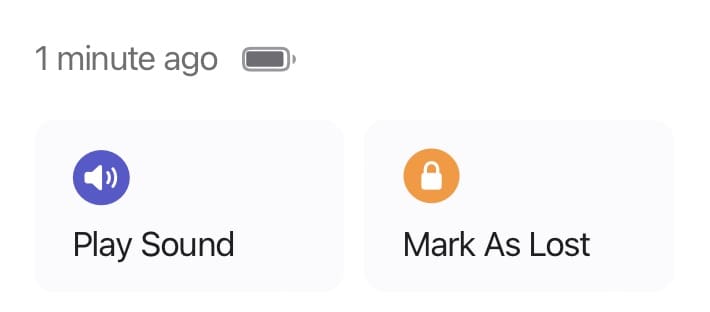

- Select your lost device from the list. Then, tap Mark As Lost.

Report Your Lost Device

As per Green Dot bank’s agreement, you Must Notify them/Apple for lost or stolen devices, compromised credentials, and unauthorized activity on your Apple Pay Cash account. If you believe that any of these have occurred, you need to reach them at (866) 795-7597.

How Do You Close an Apple Pay Cash Account?

The important thing to remember is that turning off Apple Pay Cash using your iDevice settings DOES NOT close your Apple Pay Cash account.

Once your balance in the account is zero, you will need to contact Apple to close your account. Please note that you will need to maintain a $0 balance on your Apple Pay Cash card for at least 30 consecutive days before you contact Apple to close the account. This is as per the rules established by Green Dot bank.

Is Apple Pay Cash Just a Fad?

Definitely not. Apple Pay Cash is an incredibly popular service in the US, with many people using it to quickly transfer money between their friends and family.

Cashless payments in the US continue to increase, and Apple Pay Cash is also an easy way to pay for items at different establishments throughout the country. Roomates are using Apple Pay Cash to split rent and utilities, while parents can use the app to pay the babysitter. You can also split the bill at dinner, plus much more.

Can I Use Apple Pay Cash on Android?

No. At the time of writing, Apple Pay Cash is only available on iOS, iPadOS, and watchOS.

Is Apple Pay Cash Available in Europe?

Currently, Apple Pay Cash is only available in the US.

Are There Any Fees Associated With Apple Pay Cash?

For instant transfers, you’ll need to pay a 1.5% fee. The minimum fee you’ll pay is $0.25, and the maximum is $15. This is the case for both Apple Pay Cash and Apple Cash Family.

If you don’t mind waiting a little longer for your money, you can transfer money without needing to pay fees.

How Long Do Apple Pay Cash Transactions Take to Reach My Bank Account?

If you don’t use the instant transfer feature, you can expect transferred money to reach your bank account withi 1-3 days.

What Are Some Apple Pay Alternatives?

If you don’t live in the US, you can always send money to and from others — while also paying for items — without Apple Pay Cash. Transferring money to others via your bank accounts is one option, though this can sometimes be an ineffiecient way to go about things.

You can also try using mobile-only banks like Revolut. PayPal is another viable option for sending and receiving money.

Do All Stores Accept Apple Pay Cash?

Not all stores accept Apple Pay Cash or Apple Pay, but a large number do. Walmart is one such example. However, you can use Apple Pay Cash in many outlets throughout the US. Use the feature wherever you see the Apple Pay logo.

Will Apple Pay Cash Cancel My Transaction if I Don’t Have Insufficient Funds?

While Apple Pay Cash uses the money in your account first, it will take money from your linked bank account or credit card if there isn’t any there. However, if you don’t have money in your linked account or on your card, you won’t be able to complete transactions.

Are There Monthly Fees for Using Apple Pay Cash?

No — you don’t need to pay a monthly subscription fee to use Apple Pay Cash.

Important Considerations when Using Apple Pay Cash

There are certain important aspects that you should be aware of if you plan on using Apple Pay Cash feature on your iDevice. Below are the most essntial things to consider.

- Please remember that Your Apple Pay Cash Card is not a credit card and does not provide overdraft or any line of credit.

- Bank transfers aren’t deposited on weekends or bank holidays.

- Your Apple ID is a cornerstone to this feature. Apple is offering the Pay Cash service in partnership with Green Dot bank. This service requires that your Apple ID has a “Good Standing”. If you delete your Apple ID, get rid of your Eligible Device, disable security features on your Apple ID that Apple requires to access or use features of Apple Pay, or otherwise cease to have an Apple ID that is in good standing or an Eligible Device, you may not be able to use or continue to use the Services (in whole or in part).

- Closing your Apple Pay Cash account is easy, but there is one main condition. According to Green Dot Bank’s agreement, you are required to maintain a ZERO balance for 30 Consecutive days before you can contact them to close the account.

- Some users may not be using two-factor authentication on their Apple devices. If you have not set up this feature, you should check out the FAQ from Apple regarding this security feature. You will need 2FA to use Apple pay Cash feature.

Everything You Need to Know About Using Apple Pay Cash

We hope that we addressed some of the key questions and concerns that you may have around using the new Apple Pay Cash feature. It is a very intuitive feature that is very easy to use. It can save time when it comes to paying out smaller cash amounts for services that we consume or sending small amounts of money to our family members or friends.

As with any new technology offering, it requires us to change our behavior. If you have always hated going to the ATM for withdrawing smaller amounts of cash, this will be a good way to avoid that provided all your friends and family are on Apple devices. On the other hand, if you like the way you do things now and do not want the hassle of managing yet another payment mechanism, you can choose to wait and see how this new Apple Service develops over the next few months or years.

We would love to hear from you.

Are you already using the new Apple Pay Cash service or planning to use in the near future? Are you sitting on the fence when it comes to this feature? If so what are some of the reasons that are making you shy away from this service.

Related Reading:

- How to Transfer Money With Apple Cash Card

- How to Send and Request Money From Your Apple Cash Card

- How to Set Up Apple Cash Card on an iPhone

- How to Set Up and Use Apple Pay for the Handiest Way to Pay

- How to Add Payment Cards to Your Wallet on Your iPhone and iPad

Danny has been a professional writer since graduating from university in 2016, but he’s been writing online for over a decade. He has been intrigued by Apple products ever since getting an iPod Shuffle in 2008 and particularly enjoys writing about iPhones and iPads. Danny prides himself on making complex topics easy to understand. In his spare time, he’s a keen photographer.

If a payment tries to process with my default Apple Pay card but there are insufficient funds on it, will it take money from my linked bank account?