Apple Pay is one of the most convenient ways to pay, and the fact you no longer even need to carry your bank card around is a huge benefit for many people. But despite its advancements in recent years, you cannot use Apple Pay everywhere. Even in countries where Apple Pay is accepted, you might still not be able to use it in every single store.

What’s quite annoying, however, is that figuring out which stores currently accept Apple Pay at checkout can be tricky. So, here’s everything you need to know about which stores don’t accept Apple Pay (and why), as well how to find out which stores do.

Related Reading:

- How to Set Up and Use Apple Pay for the Handiest Way to Pay

- Is Apple Pay Really Safe? Here’s What You Need to Know

- How toUse Apple Pay When Traveling Abroad

- How to Add Payment Cards to Your Apple Wallet on iPhone and iPad

- Update Payment Details on iOS Problem: How to Fix

- How to Switch Your Default Card in Apple Pay

Contents

Where Can’t You Use Apple Pay?

While Apple Pay is accepted by a wide range of different retailers, there are still quite a few companies that don’t support the proprietary Apple payment platform.

For the most part, these retailers fall into one of two categories: Stores that simply don’t take Apple Pay yet and stores that have no plans to take Apple Pay.

No matter which category they fall in, there are a number of bigger retail chains from across the spectrum that don’t currently don’t take Apple Pay. That includes:

- Walmart

- Kroger

- Guitar Center (At some locations; others do accept Apple Pay)

- Sam’s Club

- H-E-B

Some of these chains support contactless payment systems, but don’t support Apple Pay. Walmart, for example, has contactless payment platforms available for its own first-party Walmart Pay. The same goes for H-E-B. Many retailers have facilitated Apple Pay purchases over recent years, so the number will hopefully further increase in the future.

Does Walmart Support Apple Pay?

We are always asked by users if Walmart supports Apple Pay, but Walmart is one of the few companies that has resisted jumping onto the Apple Pay bandwagon.

If you are using Walmart for online purchases, there are a few ways if you can complete your purchases. In this detailed article below, we walk you through some of the possibilities of shopping online on Walmart using your iPhone or iPad.

Stores That Turned Off Apple Pay Support

Additionally, there’s actually a third category of store. Stores like JCPenney used to take Apple Pay, but for one reason or another, they cut off support for the payment method. Since that, however, they’ve brought back their Apple Pay purchase methods.

There’s also the question of why these stores don’t take Apple Pay (or why they turned off Apple Pay support). We’ll get to that below, but the general takeaway is that you’ll need to whip out a credit card or cash at these major retail chains.

Smaller Retail Stores

Keep in mind that these are just major retailers that won’t take Apple Pay. There are undoubtedly plenty of smaller convenience stores, grocery stores, gas stations, mom-and-pop shops, and local retailers that don’t accept any type of mobile payment platform.

For the most part, those retailers probably don’t have the resources to implement NFC-based point-of-sale systems. While Apple Pay is gaining ground among the big guys, there’s a good chance that your local corner bodega isn’t going to take Apple Pay for the foreseeable future.

Why Some Retailers Don’t Take Apple Pay

One may imagine that the slow rollout of Apple Pay is Apple’s own fault. But in most cases, retailers are actually the primary reason why Apple Pay isn’t accepted everywhere.

For example, many retail chains kickstarted a consortium of companies called the Merchant Customer Exchange (MCX). The goal of that coalition was to develop ways for customers to pay for goods with their devices — and to keep technology firms like Google and Apple out of the equation.

There are a couple of reasons for that, as Recode pointed out in 2014 piece on the matter. First-party payment methods allow retailers to keep customer data away from tech firms and send coupons directly to customers, for example.

But the primary reason is that developing first-party payment methods is simply cheaper for retail companies.

Lack of Infrastructure

As mentioned earlier, there are also stores that used to accept Apple Pay but don’t anymore. That’s another situation entirely. And, at least in some cases, it has little to do with retailers attempting to develop their own first-party payment platforms.

JCPenney, for example, told TechCrunch in a statement that it disabled all contactless payment systems ahead of an April 13, 2019 deadline.

That deadline required that US merchants that accept contactless payments to also support EMV contactless chip capabilities. JCPenney didn’t have the infrastructure for that, so it took a “scorched earth” approach and disabled contactless payments across its stores entirely.

Data Collection

There may also be another somewhat more insidious reason why some retailers are less open to using third-party mobile payment systems — and Apple Pay in particular.

Apple Pay is an extremely secure platform; it features a number of mechanisms that allow it to be so impenetrable. One of those mechanisms is known as a Device Account Number (DAN).

Without going into the weeds too much, a DAN essentially allows users to make a payment without revealing the actual card number they used.

Apple Pay on your Apple Watch is going to have a different DAN than the same card on your iPhone. That makes it a lot harder for retailers to track their customers’ purchases and create a profile from that data.

The Tides are Changing

Despite all of the reasons that major retailers have to keep Apple Pay out of their stores, the tide does finally seem to be changing.

CVS Pharmacy, for example, began supporting Apple Pay at locations across the US back in October 2018. Costco, another notable holdout, started accepting the Apple payment platform in August. And perhaps most notably, Target started to accept Apple Pay and other third-party contactless payment methods earlier this year. That leaves Walmart as one of the few remaining major retailers in the US as a holdout.

Consumer demand, of course, is one reason why retailers are wavering. Apple Pay is convenient, and more and more consumers want to be able to use it at the stores that they frequent.

But one of the primary reasons why members of the MCX have started to come around is that the payment platform that they were developing, CurrenctC, was an absolute failure. While it was originally created as an Apple Pay killer, CurrentC never really made it off that ground. That’s due to several reasons, including the fact that it seems to prioritize retailers over consumers — and it didn’t really adapt to consumer habits.

Though it’s too early to tell, looking at the current industry, it’s likely that tech-based payment platforms like Apple Pay will continue to gain ground as retailer-based ones, like Walmart Pay, will fizzle out.

What’s the Future of Apple Pay?

While contactless payments were slow to take off in the US, they’ve become much more widespread in recent years. Much of that was exacerbated by the COVID-19 pandemic, which resulted in more people refusing to use cash and businesses to accept card payments. Whereas doing so was unthinkable a decade ago, you can now visit some US cities — such as New York City — without needing to use cash for your entire visit.

Speaking of the Big Apple, one huge change was on the city’s public transportation network. Since 2021, Apple Pay has been accepted at all subway stations across New York City. You can use both your bank card and Apple Pay to gain access to the subway, along with paying for the bus and more.

In the US, you can now also send money via Apple Pay with the Apple Cash Card. And as of January 2024, the US is the only country where this is possible.

How to Find Out Which Stores Take Apple Pay

At this point, we’ve purely been covering broad Apple Pay trends across the industry. But the most important thing to consumers is finding out which stores around them accept Apple Pay.

Luckily, there are a couple of methods.

Apple, for its part, has an entire webpage dedicated to its mobile payment platform. That page has an up-to-date list of major retailers that accept Apple Pay.

There are also other sites around the internet that routinely update their own lists of Apple Pay-supporting chains and stores. They’re definitely worth a browse if you want the most current information.

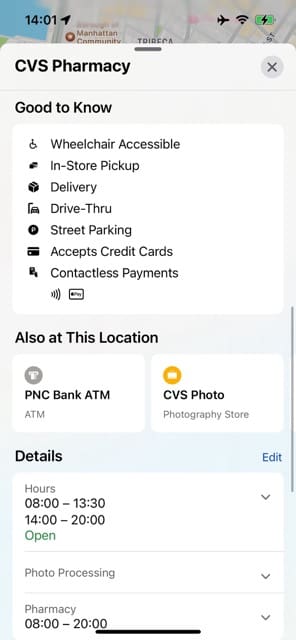

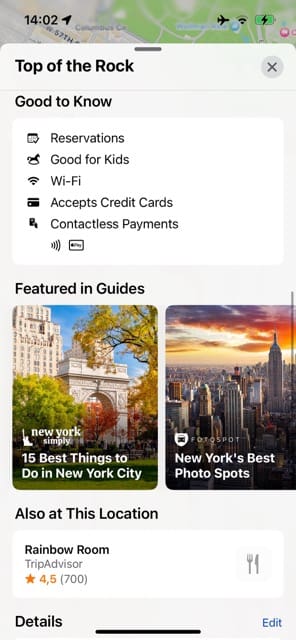

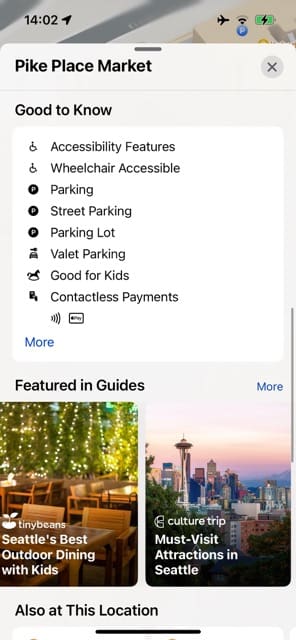

You can also use Apple Maps to see which stores around your specific location support Apple Pay. Here’s how:

- Open Apple Pay.

- Search for the store that you want to check. You can look for its specific location, along with just getting a general overview.

- Scroll down to Good to Know.

- Under Contactless Payments, you’ll see the Apple Pay logo if you can use the service at this location.

Apple Pay Isn’t Yet Universally Adopted, But It’s Much More Widespread Than It Used to Be

When understanding which stores accept Apple Pay, the topic can sometimes be complex. You’ve got a lot more options than used to be the case, and you can even use it on many public transportation networks now. But despite that, some of the biggest stores still don’t let you pay with Apple Pay.

The good news is that Apple Pay is still growing in popularity. And hopefully, those that don’t currently accept the payment method will soon do so. Before visiting somewhere, you can always check to see if a store accepts Apple Pay by going to Apple Maps and checking the Good to Know section.

Mike is a freelance journalist from San Diego, California.

While he primarily covers Apple and consumer technology, he has past experience writing about public safety, local government, and education for a variety of publications.

He’s worn quite a few hats in the journalism field, including writer, editor, and news designer.

Write a Comment